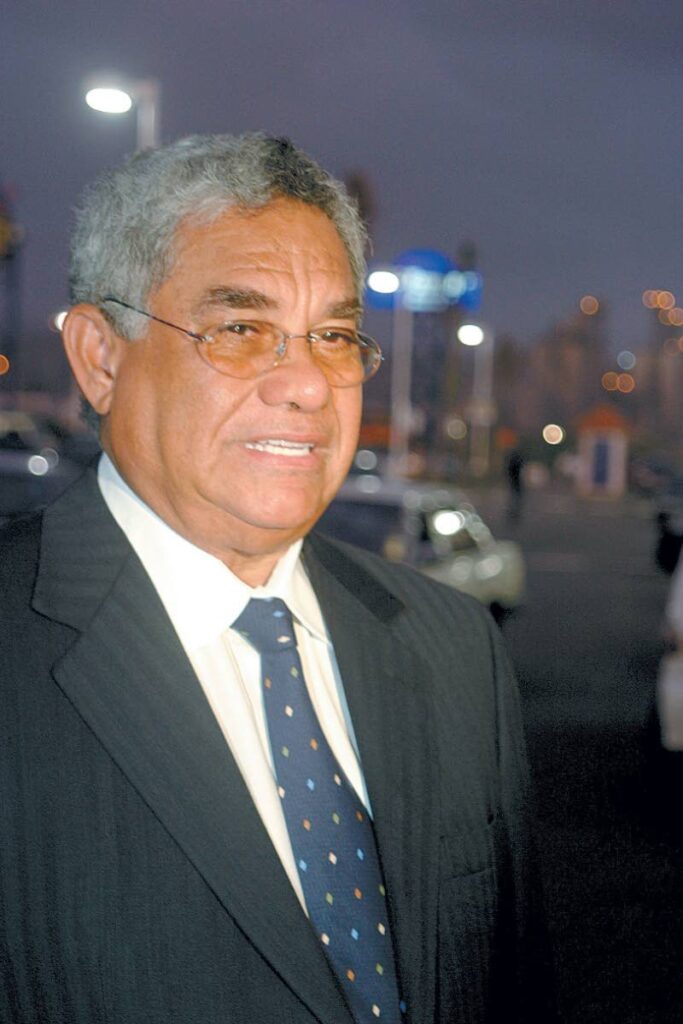

Carlos John: Remember Duprey’s good works for Trinidad and Tobago, region

Janelle De Souza

FORMER senator, government minister and CL Financial executive Carlos John says at this time, the narrative around Lawrence Duprey should not be the “short period of financial turbulence” of CL Financial, but instead, all the good things he did for the country and the region.

Duprey, former executive chairman of CL Financial, died on August 24 at 89. Sources told Newsday he had health challenges due to age but “died peacefully” at a medical facility in St James.

“I would like to focus on the jobs he created, his relationship with the staff and the opportunities he created for nationals who did not even work with him. He gave educational scholarships and funded a lot of projects that involved the underprivileged,” said John. “I want to shift the focus at this time, and probably for all time, from what happened to Clico in 2009. That’s a different debate for a different occasion.”

John said Duprey did not expect people to forget the collapse and subsequent government bailout of the group of companies and he did not expect them to, but it did not change his character.

“He was a wonderful human being – generous to a fault, a man who looked out for the man in the street. A lot of people had access to him and he, in turn, assisted them with a lot of their needs. I always refer to him as an outstanding philanthropist.”

He said they worked together closely and Duprey was considered a member of his family. He said Duprey’s death was a loss to those who knew him.

He added that, what happened “at the end” was insignificant compared to the previous decades, when CL Financial was an insurance and financial giant in the region, especially since that end resulted in “a new grand finale in which the empire is now in a good liquid financial position.”

Mickela Panday: Focus on the good

Mickela Panday, political leader of the Patriotic Front, said she was not giving any interviews on Duprey, as she had not yet spoken to his family to convey her condolences.

The Pandays seemed to have been close to Duprey, as the businessman gave Mickela’s father, former prime minister the late Basdeo Panday, the gift of an apartment in central London. Also, her mother, Oma Panday, is said to have asked Duprey for a grant for the education expenses of two of their daughters studying in London. Duprey is said to have given the family a cheque for the equivalent of TT$1.3 million.

This became a source of controversy because it did not appear in Panday’s returns to the Integrity Commission. He said he had not known about it, as Oma handled the family finances. Panday was tried and convicted over the gift, but his conviction was later quashed.

Mickela agreed with John, saying people should look at all his achievements and all he did for TT.

“What is probably more important is, when people die, like when my father died, to focus on the great contributions they made to society when there are so many people in power right now who are able to but are not doing anything at all.”

In a joint advertisement in a local newspaper on August 28, the TT Insurance Institute and the Association of TT Insurance Companies expressed their condolences to Duprey’s friends, family and colleagues. They described him as a visionary, a philanthropist and a true leader.

“In fact, Mr Lawrence Duprey used his incredible acumen to steer the family heirloom business Colonial Life Insurance Co Ltd. That feat, as well as many other examples of his exceptional work, underscore the breadth of his incredible knowledge and wisdom that will surely be missed.”

In addition to condolences, a Clico advertisement pointed out some of Duprey’s awards and achievements.

“Mr Duprey had a vision for growth, diversity and global competitiveness, which led to the establishment of CL Financial Ltd, a holding company through which investments were conducted and, as such, he was appointed executive chairman from its inception in 1993.”

It said he was awarded the Chaconia Medal (Gold) in the field of business in 1999; he was the recipient of the Distinguished Award from the Friends of TT, New York, in September 1998 for his contribution as chairman of BWIA; and received an award from the American Foundation for the UWI for his outstanding contribution to the Caribbean in January 2003.

Duprey was married to Sylvia Baldini-Duprey and had three sons.

Funeral arrangements have yet to be confirmed.

CL Financial’s collapse

CL Financial collapsed in 2009 and the next year the government bailed out the conglomerate at what became a cost of $30 billion.

In November 2010, a commission of enquiry was appointed to investigate the collapse of Colonial Life Insurance Company (Clico), a subsidiary of CL Financial. It revealed questionable transactions occurring at CL Financial Ltd as far back as 1992.

In 2017, the government successfully petitioned the High Court to liquidate CL Financial to clear the remainder of the debt it incurred in rescuing the cash-strapped conglomerate. The process is still ongoing.

In 2021, the High Court ruled Duprey acted oppressively and unfairly when he cut a deal to sell CLF and Clico’s 51 per cent stake in Process Energy (Trinidad) Ltd to Proman Holdings (Barbados) Ltd for about US$46.5 million, three days after the government had bailed out the companies.

In 2023, Justice Devindra Rampersad ordered Duprey to pay the CL Financial conglomerate, on trust, US$139,416,295, which represented the proceeds of a deal he cut for shares in Proman Holdings’ Clico Energy Company Ltd.

Separately, a group of citizens and institutions from Antigua and Barbuda and Grenada filed a claim against the Government of TT over the collapse of CL Financial and its subsidiary British American Insurance Co Ltd. It claimed the TT Government discriminated against them when it bailed out CL and its local subsidiaries.

On April 30, Caribbean Court of Justice president Justice Adrian Saunders and Justices Winston Anderson, Maureen Rajnauth-Lee, Andrew Burgess and Peter Jamadar reserved their ruling on the complaint.

In a previous interview with Newsday, Peter Permell, chairman of the Clico policyholders group, said Clico had since paid back government all of the money it used to bail it out.

In July, Clico published its consolidated financial statements for 2023 and reported an after-tax profit of $2.3 billion, an increase from the $621.4 million recorded in 2022.