Trinidad and Tobago’s balancing act between competitiveness and climate action

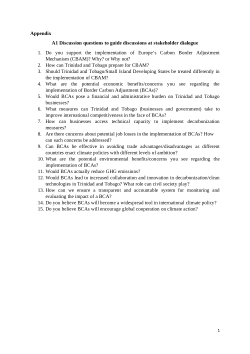

Introduction This policy analysis paper explores stakeholder perspectives on the potential impact of Border Carbon Adjustments (BCAs) as an external climate policy instrument on Trinidad and Tobago. The research is based on data collected through a questionnaire and two workshops.Discussion The study finds that while the majority of stakeholders are aware of BCAs and generally support their implementation for environmental reasons, there are concerns about their impact on the competitiveness of the country’s exports and the social consequences. Stakeholders expressed concerns about potential job losses, increased costs for consumers, and reduced competitiveness of local industries.Conclusion The research recommends the participation of Trinidad and Tobago in international discussions on BCA design to advocate for phased exemptions as the country decarbonizes and to influence key BCA design features such as geographic coverage, product coverage, emissions scope, fees and application of the fees and crediting for foreign policy. The country should also develop robust Measurement, Reporting, and Verification (MRV) systems to measure and verify domestic carbon emissions accurately. Additionally, the country should introduce policies like a carbon tax to potentially reduce emissions and the amount of taxes paid.

Government, private sector, civil society, and academia hold varying views on BCAs, ranging from cautious optimism to outright concern.

Strategic engagement with BCA implementers and relevant international organizations is important to find solutions balancing environmental, economic, and trade concerns.

Trinidad and Tobago should implement a domestic carbon pricing system which would allow the country to collect revenue generated from carbon pricing instead of having that revenue go to foreign nations.

Trinidad and Tobago should reduce emissions through technologies such as carbon sequestration, green hydrogen, energy efficiency, and renewables.

Trinidad and Tobago must develop a robust MRV system to monitor and verify its emissions.

Government, private sector, civil society, and academia hold varying views on BCAs, ranging from cautious optimism to outright concern.

Strategic engagement with BCA implementers and relevant international organizations is important to find solutions balancing environmental, economic, and trade concerns.

Trinidad and Tobago should implement a domestic carbon pricing system which would allow the country to collect revenue generated from carbon pricing instead of having that revenue go to foreign nations.

Trinidad and Tobago should reduce emissions through technologies such as carbon sequestration, green hydrogen, energy efficiency, and renewables.

Trinidad and Tobago must develop a robust MRV system to monitor and verify its emissions.